If It is simple interest problem, then we can find Total Amount to be repaid after 30 years.

The principal amount is P = $159,000.

Annual Percentage Rate is 6.5%, so R = 0.065

Time of loan repayment is 30 years, so T = 30

We can use Simple Interest formula to find the interest to be paid at maturity of loan.

Interest = Principal x APR x Time

Interest = PRT

Interest = 159000 x 0.065 x 30

Interest = 310,050

Total Amount to repay = Principal + Interest

Total Amount to repay = 159,000 + 310,050

Total Amount to repay = 469,050 dollars.

**********************************************************************************

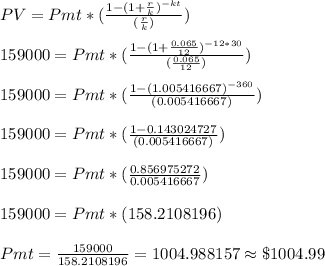

If it is monthly payment problem, then we can use Present Value formula to find the monthly payments to be repaid.

We have loan amount, PV = 159000.

r = 0.065; t = 30 years; k = 12 (compounded monthly).

So, monthly payments = $1,004.99

Total amount paid over loan period = 1004.99 x 360 = $361,795.74

Total interest paid over the loan period = $202,795.74