Answer: The amount applied to the principal balance is $1174.43.

We first calculate the Equated Monthly Instalment (EMI) of the loan by using the following formula:

![\mathbf{PV = EMI * \left [(1-(1+r)^(-n))/(r) \right]}](https://img.qammunity.org/2019/formulas/business/college/3aa45kkl4pzomwm4tjdwgyg76fc4qc5v3n.png)

where

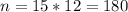

r = Interest rate per period ; n = number of periods

Substituting these in the formula above we get,

![\mathbf{295000 = EMI * \left [(1-(1+(0.0425)/(12))^(-180))/((0.0425)/(12))\right]}](https://img.qammunity.org/2019/formulas/business/college/1w5sz58prd61mlbv1f4omtjgj2jmxue8li.png)

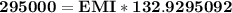

Solving we get,

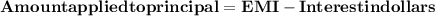

Once we get the EMI, we calculate the amount that applies to the principal balance as follows:

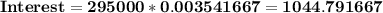

Interest is calculated on the outstanding balance of each month. In the first month, the entire principal in outstanding. Hence we calculate interest on $295,000.