Answer:

The correct solution is "$241,356".

Step-by-step explanation:

The given values are:

Share price,

P0 = 140.50

Acquisition premium,

p = 20%

Diluted shares outstanding,

N = 2,863 MM

Now,

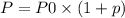

For Amazon, the purchase price every share will be:

⇒

On putting the values, we get

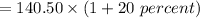

⇒

⇒

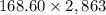

The purchase consideration will be:

=

=

=

So that,

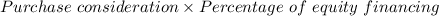

The total equity financing expected will be:

=

=

=

($)

($)

Thus the above is the correct answer.