Answer:

a. $60

Step-by-step explanation:

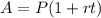

We will use simple interest formula to solve our given problem.

, where

, where

A= Amount after t years.

P= Principal amount.

r= Interest rate in decimal form.

t= Time in years.

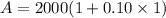

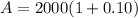

Let us find amount of loans repayable after 12 months for taking two amounts of $2000 and $1000.

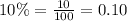

As $2000 and $1000 are less than 2500, so the rate of loan will be 10%.

12 months = 1 year.

Now let us find amount repayable after 12 months for borrowing $1000.

Adding these amounts we will get total repayable amount after 12 months for borrowing $2000 and $1000 separately.

Now let us find repayable amount after 12 months for taking 1 loan. As $3000 is between $2501 and $7500, so rate of loan will be 8%.

Now let us find difference between both repayable loan amounts.

Therefore, the customer should have saved $60, if he had taken out one loan for $3000 and option a is the correct choice.