The investor will show a capital loss of $155.

We gather the following information from this question:

Pop of the fund three years ago : $12

NAV of the fund three years ago : $11.50

Current Pop : $11

Current NAV : $10.45

Number of shares : 100 shares.

We need to calculate capital loss or gain on the 100 shares in the mutual fund.

While taking the cost per unit, we need to consider the public-offer-price (pop) into consideration, since an investor can only buy the shares at pop.

Similarly, while selling the shares, the shareholder can liquidate his position by selling back to the mutual fund at the NAV prevailing at the end of the business day on which he wants to sell.

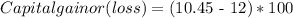

So, the formula to calculate capital gain or loss is: