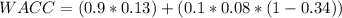

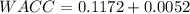

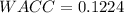

Answer : The company's weighted average cost of capital (WACC) is 12.24%

We have:

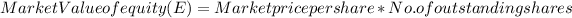

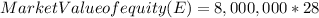

No. of outstanding shares = 8,000,000

Market price per share = $28

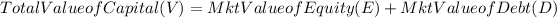

Face Value of Debt = $24,000,000

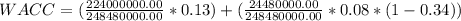

![Market Value of debt (D) = $24,000,000 * 1.02 [/tex<strong>]</strong></p><p><strong>[tex] Market Value of debt (D) = 24480000](https://img.qammunity.org/2019/formulas/business/middle-school/e52l4sleuf6576dpaheupiqj6pk1pjet08.png)

Total capital (V) = $248,480,000

WACC = (\frac{E}{V}* R_{e}) + (\frac{D}{V}* R_{d}*(1 - T))