Answer : The calculated answer of FVA is $ 2,57,499.14. This is closest to $257,502.00 - option B.

We follow these steps to arrive at the answer:

We use the Future Value of Annuity formula to arrive at the answer to this question, as the new account begins at $0.00 and there is no mention of the amount in the previous account.

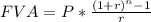

The formula for Future Value of annuity is:

where

P = constant periodic contribution

r = rate per period

n = number of periods.

In the question above, P = $7,000.

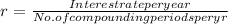

The given interest rate is 12% p.a. Since the contributions are made semi-annually (twice a year), we need to find the rate per period with the following formula:

So, we get

r =

r = 0.06

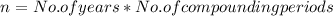

Since there are two compounding periods per year, we get number of compounding periods 'n', by

So,

n = 20

Substituting the values of P, n and r in the FVA equation we get,