The question is incomplete. The complete question is :

The one-year forward rate of the British pound is quoted at $1.60, and the spot rate of the British pound is quoted at $1.63. The forward ________ is _______ percent.

Solution :

The future yield of any bond is known as the Forward Rate. It is the interest rate that is applicable to any financial transaction which will occur in the future.

According to the question,

The forward rate of the British pound for one year is = $ 1.60

The spot rate of the British pound is = $ 1.63

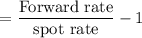

Therefore,

= 0.98 - 1

= -0.018

Thus it is forward discount and the percentage is 1.8 %