Answer:

AP have to sell 88,000 units to make a profit of $60,000 before taxes.

Step-by-step explanation:

The question is incomplete. The variable and fixed costs are missing.

The variable costs are:

- Manufacturing: $7/unit

- Administrative: $4/unit

- Selling: $2/unit

The fixed costs are:

- Manufacturing: $132,000

- Administrative: $72,000

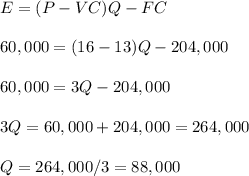

The total variable costs per unit are (7+4+2) = 13 $/unit.

The total fixed costs are: (132,000+72,000) = $204,000.

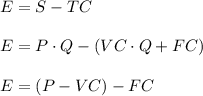

The profit before taxes is defined in this case as the difference between sales and total costs.

Sales is the product between the price and the quantity or number of units sold.

Then, we can express the profit E as:

being P: price per unit, VC: variable cost per unit, Q: units sold, FC: fixed costs.

For a profit E=60,000, we can calculate the quantity Q as:

Then, AP have to sell 88,000 units to make a profit of $60,000 before taxes.