Answer:

Ending Inventory= $1603 and Cost of goods sold= $2087.

Step-by-step explanation:

Here is the complete question: The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 280 units, where 260 are from the January 30 purchase, 5 are from the January 20 purchase, and 15 are from beginning inventory.'

Determine the cost assigned to ending inventory and to cost of goods sold using Specific identification method.

First, lets find out Ending Inventory:

Value of units taken as per the date of purchase.

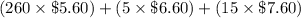

Ending Inventory=

⇒Ending Inventory=

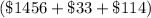

Opening parenthesis.

∴Ending Inventory= $1603.

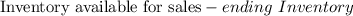

Now, finding cost of goods sold.

Cost of goods sold=

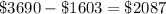

Cost of goods sold=

∴ Cost of goods sold= $2087