Answer:

The reutrn on equity should be of 9.53%

Step-by-step explanation:

We can solve the return on equity by considering the gordon model of dividend growth:

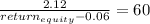

current dividends 2 dollars

next year dividends: current x (1 + g) = 2 x (1 + 0.06) = 2.12

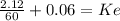

Ke = 0.09533 = 9.53%