Answer:

$73000

Explanation:

Given: Social security tax paid by Yolanda is $4562.

6.2% tax to be paid on earning to the maximum income of $128400.

Lets assume Yolanda´s income be `x`.

Now, calculating the taxable income of Yolanda

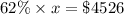

∴

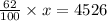

⇒

Cross multiplying both side

⇒ x=

∴x= $73000

∴ Yolanda´s taxable income is $73000.