Answer:

Yuki paid $18.15 sales tax on purchasing a hand bag of $220.

Explanation:

Given:

Price of handbag = $220

State Sales tax = 4.6%

Country Sales tax = 3.65%

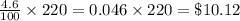

Amount paid in State Sales tax = Percent State sales tax

Price of handbag =

Price of handbag =

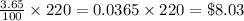

Amount paid in Country Sales tax = Percent Country sales tax

Price of handbag =

Price of handbag =

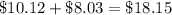

Hence Total Amount paid in sales Tax = Amount paid in State Sales tax + Amount paid in Country Sales tax =

Yuki paid $18.15 as Sales tax on purchasing a hand bag of $220.