Answer:

Option D

Explanation:

Given question is incomplete; here is the complete question.

Asako deposits $1000 into a bank that pays 1.5% interest compounded annually. Which inequality can she use to determine the minimum time in years 't' she needs to wait before the value of the account is 20% more than its original value?

A. 1000 . 1.01t > 1200

B. 1000 . 1.01t > 1.2

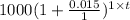

C.

D.

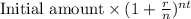

Formula to get the final amount by compounding is,

Final amount =

Here, r = rate of interest

n = number of compounding in a year

t = Time or duration of investments (In years)

Initial amount = $1000

Final amount = 20% more than its original value = $(1000 + 0.2×1000) = $1200

r = 1.5% = 0.015

Inequality that represents the final amount 20% more than the initial value,

> 1200

> 1200

> 1.2

> 1.2

Therefore, Option D will be the correct option.