Answer:

$ 55135.978

Explanation:

At most, the present value of annuity must be paid. So we must find the present value of the annuity

Given in the problem, we have:

Periodic Payment = PMT = $10000

Rate of interest annually = i = 6.35 %=

=0.0635

=0.0635

no. of periods= n=7

So to solve this, we need to use the present value formula:

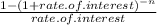

Present Value = Periodic payment

Present Value = PMT

Present value = 10000

Present Value =10000

Present Value =10000 (5.5135978)

Present value= $ 55135.978

Which is the amount that must be paid at most to get annuities such that $10,000 annually over the 7-year period are to be received.