Answer:

$195.33

Explanation:

To calculate credit card interests we need to use its balance, because if a person makes several purchases, then the balance will be different each day. But, in this problem, we assume that these parents only make one purchase, which is given.

We need to use the APR which is the Annual Percentage Rate, which is give by the credit card company. So, the normal procedure to calculate the interest that the parents will pay, we should calculate the Average Daily Balance and then divide it by number of days involved. But, again, in this problem, we have only one purchase all along, which means that the balance remains constant, during the complete 12 months period.

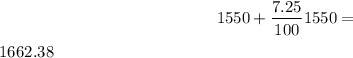

At the end, all these factors about the problem make it easier, because we only need to apply the APR to the final price of the purchase, due to the constant balance. In this sense, the final price is $1550 plus the sales tax (7.25%), that is:

As you can see, the final price is $1662.38, which was calculated considering the sales tax, that is, the price percentage extra.

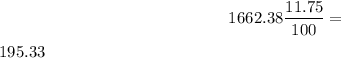

Then, If we multiply this final price with the APR of the credit card:

Hence, the interest is $195.33

PD: When we operate percentages, we divide the number by 100, to have the decimal equivalence of the percentage.