Answer:

option (A) $1,384.24

Step-by-step explanation:

Given:

Free Cash Flow in Year 3 = $88 million

Expected growth rate = 10% = 0.1

Constant Growth Rate, gC = 4%

Gonzales Corporationʹsexpected terminal enterprise value in Year 2

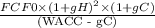

=

=

Here,

FCF3 is the Free Cash Flow in Year 3

FCF3 is Free Cash Flow Now

=

= $1,384.24

Hence,

The correct answer is option (A) $1,384.24