Answer:

Option a.

Step-by-step explanation:

Given information:

Face value of bond = $100,000

Interest rate of bonds = 8%

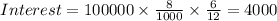

Interest is paid semi annually, So the value of interest is

Market interest rate = 9%

Time = 25 years

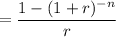

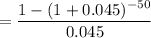

Present value of annuity factor

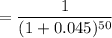

Present value factor

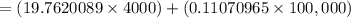

Value of bond = (Present value of annuity factor × interest payment) + (present value factor × face value)

Value of the bond

The issue price of the bonds is $90,119.

Therefore, the correct option is a.