Answer:

After 7 years and 5 months.

Explanation:

Let x represent number of years.

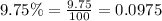

We have been given that a certain company recently sold five-year $1000 bonds with an annual yield of 9.75%.

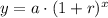

We can see that the value of bond is increasing exponentially, so we will use exponential growth formula to solve our given problem.

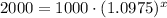

, where,

, where,

y = Final value,

a = Initial value,

r = Rate in decimal form,

x = Time

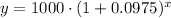

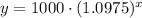

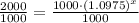

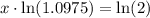

Substituting given values:

Since we need the selling price to be twice the original price, so we will substitute

in above equation as:

in above equation as:

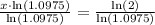

Switch sides:

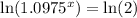

Take natural log of both sides:

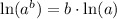

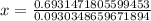

Applying rule

:

:

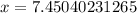

Since x represents time in years, so we need to convert decimal part into months by multiplying .4504 by 12 as 1 year equals 12 months.

7 years and 12*0.4504023 months = 7 years 5.4 months = 7 years 5 months

Therefore, after 7 years and 5 months the company could sold the bonds for twice their original price.