Answer:

17.53%

Explanation:

Let, Essie has used $x with her credit card on the first day of the year.

So, for the next 60 days, she does not have to pay any interest, but after 60 days he has to pay 19.34% APR compounded daily.

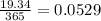

So, the daily percentage rate is

%

%

So, after 1 year the daily percentage rate is compounded for (365 - 60) = 305 days.

Then, principle $x will grow up to $

![x[1+(0.0529)/(100) ]^(305) = 1.1753x](https://img.qammunity.org/2020/formulas/mathematics/middle-school/nlnq7aues17e9c3q783yw50rdwmzqr1vj7.png)

If this interest rate is equivalent to y% APR which compound yearly, then

![x[1+(y)/(100) ] = 1.1753x](https://img.qammunity.org/2020/formulas/mathematics/middle-school/6d26t7aj8yl9mak3ss6eorcda7mysyw2mw.png)

⇒ y = 17.53% (Answer)