Answer:

0.0556 or 5.57%

Step-by-step explanation:

Given that,

stock has a beta = 1.25

Dividend paid by company, D1 = $0.40

Expected growth rate of dividend, g = 5%

Expected return on the market, r = 12%

Treasury bills are yielding, t = 5.8%

Recent stock price for Berta, p = $75

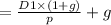

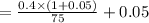

Common stock (under DCF method):

= 0.0056 + 0.05

= 0.0556 or 5.57%