Answer:

Expected dividend will be $2.44

So option (b) will be correct option

Step-by-step explanation:

We have given required rate of return = 10.25 % = 0.1025

Value of stock= $57.50

Growth rate = 6 % = 0.06

We have to find the expected dividend

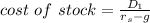

We know that cost of stock is given by

, here

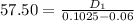

, here

is expected dividend

is expected dividend

is return ratio and g is growth rate

is return ratio and g is growth rate

So

So option (b) will be correct option