Answer:

D. $150.80

Explanation:

We know from the problem that sale tax is 6%.

The water skis price was $180.

Rico had a $40 coupon, which is applied after sale tax.

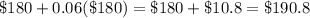

So, including sale tax, the price would be

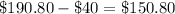

Then, including the $40 coupon, the final price would be

Therefore, the right choice is D.

Remember that you have to include the sale tax, which increases the price, and then you can applied the coupon discount.