Answer:

The cost of capital for the firm is 12.75%

Step-by-step explanation:

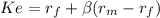

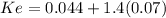

from the CAMP model we can determinatethe rate as follow:

risk free 0.044

premium market = (market rate - risk free) = 0.07

beta(non diversifiable risk) = 1.4

Ke 0.14200 = 14.2%

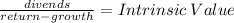

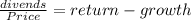

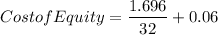

from the dividend grow model:

D0 = 1.60

D1 D0 x (1+g) 1.60 dollars x 1.06 = 1.696

P $ 32

g 0.06

Ke 0.113 = 11.3%

we can do an average betwene the two methods:

(14.2 + 11.3)/2 = 12.75