Answer:

The IRR of this investment is 5.5%

Step-by-step explanation:

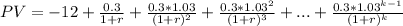

First we need to express the present value of this investment

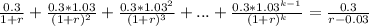

From the second term we have a perpetuity with growth rate, which we resolve as

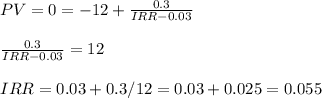

Then we can replace r by IRR and PV equal to zero and we have

The IRR of this investment is 0.055 or 5.5%