Answer:

Valence's share price is $152.47

Step-by-step explanation:

Given:

Payout percent = 40% or 0.4 (includes 15% dividends and 25% repurchases)

Total earnings = $850,000,000

Cost of capital = 8%

Dividend growth rate = 7%

Total payout = 0.4 × 850,000,000 = $340,000,000

We need to compute present value of total payout (dividends and repurchases) which is computed as shown below:

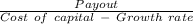

Present value of payout =

Present value of payout =

= $34,000,000,000

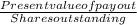

Now compute price of share:

Price of share =

=

= $152.47