Answer:

Explanation:

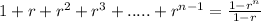

Taking the succession:

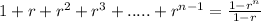

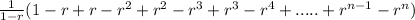

You can multiply and divide by 1-r without chaging the result:

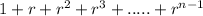

Distributing the upper part of the fraction you have:

As can be seen all the intermediate members will be canceled by a same member with opposite sign, only

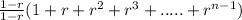

will be left so:

will be left so: