Answer:

$ 388.77

Explanation:

First, let's change the annually interest(ia) for monthy (im):

(1+ im)¹² = 1 + ia

(1 + im)¹² = 1 + 0.04125

1 + im =

1 + im = 1.00337

im = 0.00337

im = 0.337%

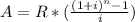

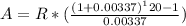

The total amount (A) of the investment can be calculated by:

Where R is the amount invested by month, n is the number of months, and i is the interest.

10 years = 10*12 = 120 months

50,000= R*147.59

R = $ 388.77