Answer:

accumulated depreciation = 241667

depreciation for 2016 = 6800

book value as December 2017 = 240000

Step-by-step explanation:

solution

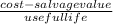

we know SLM depreciation per month is express as

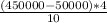

depreciation =

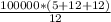

put here value

depreciation =

depreciation = 100000

and

accumulated depreciation as of 31st December is

accumulated depreciation =

accumulated depreciation = 241667

and

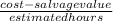

depreciation per hour is

depreciation =

depreciation =

depreciation per hour = 8

so depreciation for 2016 = 8500 × 8 = 6800

and

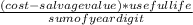

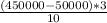

as depreciation by sum of year of digit method

depreciation =

so here sum of years digit = 1 + 2 + 3 + 4 = 10

so 1st year depreciation =

= 160000

= 160000

and next year depreciation =

= 120000

= 120000

so depreciation from august 2016 to july 2017 = 160000

and depreciation from august 2017 to December 2017 =

= 50000

= 50000

so book value as December 2017 = 450000 - 160000 - 50000

book value as December 2017 = 240000