Answer:

Ans. The cost of equity capital is 6.5 (6.5%)

Step-by-step explanation:

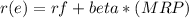

Hi, all we need to do is fill the following equation with the data from the problem.

Where:

rf = Risk free rate (in our case, 2%)

MRP = market risk premium (in our case, 6%)

r(e) = Cost of equity capital

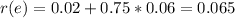

Therefore, this is what we get.

So the cost of equity capital is 6.5% or 6.5 as the problem suggests to answer.

Best of luck.