Answer:

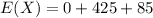

$510

Explanation:

Let X be the amount of money that insurance company will have to pay on the policy for home.

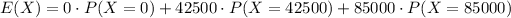

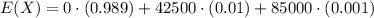

It is given that according to experience, may sustain a total loss in a given year with probability of .001 and a 50% loss with probability .01. Ignoring all other partial losses.

It means the possible values for variable X are 0, 42500 and 85000.

We have only three possible values of X. So,

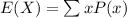

The expected amount of money is

Therefore, the insurance company should charge a premium of $510 for a yearly policy in order to break even on all $85,000 policies in this area.