Answer:

withdraw each month is $6,902.37

Step-by-step explanation:

given data

time = 25 year

invest = $700 per month

stock amount = $300 per month

expected rate = 9% =

bond account = 5%

return = 6%

to find out

withdraw each month from account for 20 year withdrawal period

solution

we will apply here future value formula that is

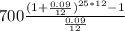

FV =

...............1

...............1

here P is principal amount i.e $700 given and r is are and t is time

so

The value of the stock account at retirement will be

value of the stock account =

value of the stock account = $784,785.36

and

value of the bond account at retirement will be

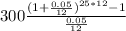

value of the bond account =

value of the bond account = $178,652.91

and

so value of the two accounts combined is here

= $178,652.91+$784,785.36 = $963,438.27

so

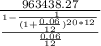

monthly withdrawal from combined account is

amount =

...............2

...............2

amount =

amount = $6,902.37