Answer:

Contribution margin ratio = 1 - variable cost ratio

= 25%

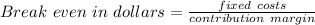

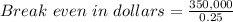

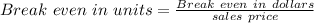

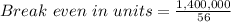

(a)

= 1,400,000

= 25,000

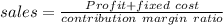

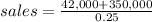

(b) For profit of $42,000,

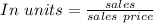

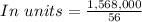

= 1,568,000

= 28,000

(c) variable cost = sales price × variable cost ratio

= $56 × 75%

= $42

New contribution margin =

New contribution margin =

= 0.4

= 40%

= $875,000

= 12,500