Answer:

$14.25

Explanation:

We can use DDM (Dividend Discount Model) to answer this.

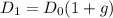

Firstly we have:

Where D_1 is the dividend next year

D_0 is current divident

g is the growth rate (or decline rate)

We need to find until D_3 since we want stock price in 3 years.

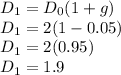

So,

we know D_0 = 2

g = -0.05

Now, we have:

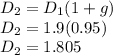

Now calculating D_2:

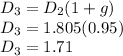

Calculating D_3:

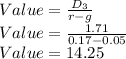

The stock price follows the formula:

Where D_3 is dividend in 3 years [1.71]

r is the required rate of return [17%]

g is the growth rate [-0.05]

Now, we have:

Thus, $14.25 in 3 years