Answer:

first year = 300

second year = 275

Step-by-step explanation:

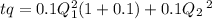

The cost will be for year 1 and year 2 extractions for the first year we must consider the cost is increased by the rate as it could be used to invest at 10%

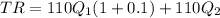

we revenue will be the first year plus the interest.

And then, second year revenue

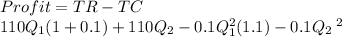

Profit will be revenue less cost:

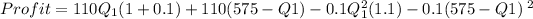

lastly, we know the total amount we an extras is 575 tons so

q1 + q2 = 575

We can replace Q2 as an expression of q1

q2 = 575 - q1

and now we try to solve to get the quadratic.

121Q1 + 63250 - 110Q1 -0.11Q2 - 33,062.5 +115q1 -0.1Q12

126Q1 + 30,187.5 - 0.21Q12

-0.21Q2 + 126Q + 30,187.5

As this is a quadratic function the max point will be at vertex

now we solve for the vertex of the quadratic function

-b/2a

126/0.21*2 = -104/0.4 = 300

Q1 max out the profit at 300

Q2 will be 575 - 300 = 275