Answer:

Finished goods 1,100,000 debit

WIP inventory 1,100,000 credit

--transferred-out units for Job N51--

Step-by-step explanation:

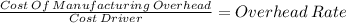

The company applied overhead based on labor cost:

300,000 / 200,000 = 1.5

We now multiply this rate by the actual labor hours to know how much we apply.

220,000 x 1.5 = 330,000

now, the total cost will be:

Materials 550,000

Labor 220,000

Applied MO 330,000

Cost 1,100,000

This is the amount we transfer into finished goods.

At the end of the period, when the actual overhead values are know we adjust the difference against cost of goods sold.