Answer:

Pre-tax Cost of debt 7.35%

After-tax Cost of debt 4.78%

Step-by-step explanation:

We will calculate the cost of debt which is the rate at which the present value of the coupon payment and maturirty matches with the market value.

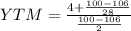

Coupon payment =100 x 8% / 2 = 4

Face value= 100

market Value = P= 106

n= total payment = 14 years x 2 payment per year = 28

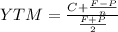

YTM = 3.6754508%

As this rate will be semiannually we multiply by 2

3.6754508 x 2 = 7.3509015 = 7.35%

Then we calcualte the cost of debt after tax:

pretax (1-t)

7.35 (1-.35) = 7.35(0.65) =4,7775 = 4.78%