Answer:

The depreciation is $52,500

Step-by-step explanation:

The formula to compute the depreciation under the straight-line method is shown below:

=

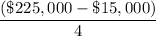

=

= $52,500

Under the straight-line method, the depreciation expense should be the same for the remaining useful life. Life of the equipment or machine should always be expressed in years, not in hours.

So, these usage of hours should be ignored.