Answer:

$2191.12

Explanation:

We are asked to find the value of a bond after 10 years, if you invest $1000 in a savings bond that pays 4% interest, compounded semi-annually.

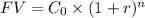

, where,

, where,

,

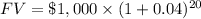

,

r = Rate of return in decimal form.

n = Number of periods.

Since interest is compounded semi-annually, so 'n' will be 2 times 10 that is 20.

Therefore, the bond would be $2191.12 worth in 10 years.