Answer:

the annual rate of return on the painting was -13.17%

Step-by-step explanation:

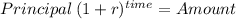

we will construct the equation for future value at the annual rate of return at which a principal of 1,680,000 return 1,100,000 in three years:

Principal 1,680,000

time 3 years

Amount 1,100,000

rate r

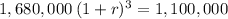

![r = \sqrt[3]{ 1,100,000 / 1,680,000} -1](https://img.qammunity.org/2020/formulas/business/college/jhl2d5frdug7emumcj5x86o9uwr9fu8d1k.png)

r = -0.131650681 = -13.17%

As expected, because the amount after three years is lower than the principa the rate of return is negative