Answer:

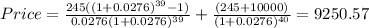

Ans. Price of the bond is $9,250.57

Step-by-step explanation:

Hi, first we need to establish the semi-annual coupon of the bond and the semi-annual discount rate (YTM semi-annually)

Coupon=10000*(4.9%/2)= $245

To turn the annaul YTM to semi-annual, we have to use the following equation

After all this, we are ready to find the price, here is the math of this.

Best of luck.