Answer:

The answer is : yield to maturity= 7,14%

Step-by-step explanation:

Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield but it is expressed as an annual rate. It is the internal rate of return (IRR) of an investment in a bond if the investor holds the bond until maturity, with all payments made as scheduled and reinvested at the same rate.

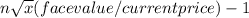

The formula to calculate YTM is:

YTM=

n = number of years to maturity

Face value = bond’s maturity value or par value

Current price = the bond's price today

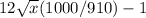

In this case, we don't have the information regarding face value, but it is customarily $1,000. The face value is is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer.

YTM=

=7,14%

=7,14%