Answer:

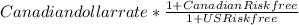

The one year forward rate is 1.2709.

Step-by-step explanation:

The spot rate means that you have to pay 1.2648 canadian dollar for each united states dollar.

The rate parity is the future rate that reflects the cost of carrying the underlying asset (in this case, the US dollar), for the period under analysis.

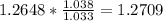

The formula for determinating the one year forward rate is

So with numbers will be