Answer:

(A) Investment of 6,700 discount payback period 1.82

(B) Investment of 8,800 discount payback period 2.34

(C) Investment of 11,800 discount payback period 3.06

Step-by-step explanation:

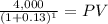

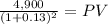

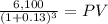

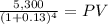

We will discount each cash flow at 13%

3539.823

3837.4187

4227.606

3250.5893

We need to look at which year we get the investment amount

We will do: accumalted cash flow less investment

and then divide by the last year to get at which portion of this year we achieve payback period

(A) 6,700

3540 + 3837 = 7377

It will be between the first and second year

6,700 - 3,540 = 3160

3160/3837 = 0.8235

payback period 1.8235

(B) 8,800

3540 + 3837 + 4228 = 11605

It will be between second and third year

we do 8,800 - 7377 = 1423

1423/4228 = 0.3365

payback 2.3365

(C) 11,800

3540 + 3837 + 4228 + 3251 = 14856

It will be between third and fourth year

11,800-11,605 = 195

195/3251 = 0.0599 = 0.06

payback 3.06