Answer:

Market rate of return on stock = 11.2152%

Step-by-step explanation:

Details provided are

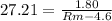

Market rate per share = $27.21

Dividend to be paid at year end = $1.80

Expected dividend growth rate = 4.6%

Expected return of market has to be calculated.

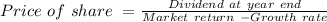

Using the dividend growth model we have,

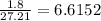

Market return - growth =

Market return = 6.6152 + 4.6 = 11.2152%

Market rate of return on stock = 11.2152%