Answer:

cost of equity = 9.94%

Step-by-step explanation:

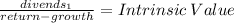

we use the gordon dividend growth model to solve for cost of capital

we clear cost of capital

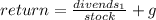

Now, we plug the values into the formula and solve:

we have the last week dividend (t= 0)

we need the dividend of next year so we apply the grow rate

2.4 x 1.04 = 2.496

Stock 42

g = 0.04

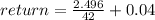

return = 0.099429 = 9.94%