Answer:

The price of the bond =$4,244.64

Step-by-step explanation:

The price of a bond is equivalent to the present value of all the cash flows that are likely to accrue to an investor once the bond is bought. These cash-flows are the periodic coupon payments that are to be paid semi-annually and the par value of the bond that will be paid at the end of the 11 years.

During the 11 years, there are 22 equal periodic coupon payments that will be made. In each year, the total coupon paid will be

and this payment will be split into two equal payments equal to

. This stream of cash-flows is an ordinary annuity

. This stream of cash-flows is an ordinary annuity

.

The yield to maturity is equal to 4.2% per annum which equates to 2.1% per semi annual period.

The PV of the cash-flows = PV of the coupon payments + PV of the par value of the bond

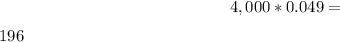

=98*PV Annuity Factor for 22 periods at 2.1%+ $4,000* PV Interest factor with i=2.1% and n =22

![= 98*([1-(1+0.021)^-^2^2])/(0.021)+ (4,000)/((1+0.021)^2^2) =$4,244.6375](https://img.qammunity.org/2020/formulas/business/college/itqevlrfswsklfk669ieat3n7nb8glyvup.png)