Answer:

$80,000

Step-by-step explanation:

From the information given:

2020 = $320000

2020 = $320000

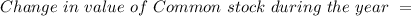

= i.e. 2020 = $570000

= i.e. 2020 = $570000

= i.e. 2019 = $530000

= i.e. 2019 = $530000

Change = $570000 - $530000 = $40,000

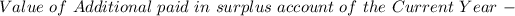

= $2,500,000

= $2,500,000

= $2,300,000

= $2,300,000

Change = $2,500,000 - $2,300,000 = $ 200000

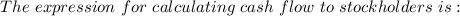

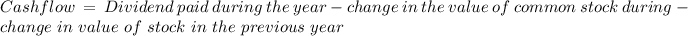

∴

= $320000 - $40,000 - $ 200000

= $80,000