Answer:

C) The higher the discount rate, the lower the NPV of a cash flow.

Step-by-step explanation:

Net Present Value (NPV) is the net value of discounted cash flows taken together, whether inflow or outflow.

It is discounted on the specified rate of interest of discount.

Now higher the rate lower will be NPV

For instance cash flow = $10,000 at each year end

Interest rate = 10% and 15%

Value at first year end in both cases will be,

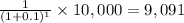

At 10% =

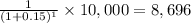

At 15% =

Now higher the rate lower the NPV thus above stated statement is true.