Answer:

Stock's expected price 3 years from today = $11.165775

Step-by-step explanation:

Provided information

and using dividend growth model we have,

D1 = $0.75

g = 6%

Ke = 14%

For cost at the end of 3 years we need to calculate D4

D2 = D1 + g = $0.75 + 6% = $0.795

D3 = D2 + g = $0.795 + 6% = $0.8427

D4 = D3 + g = $0.8427 + 6% = $0.893262

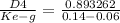

P3 = Price at the end of year 3 =

P3 = 11.165775